Quick Apply Credit Cards, Loan, Mortgage & Car Insurance in UAE

Secure the Perfect Personal Loan in the UAE

Your trusted broker for finding and applying for the right personal loan. We connect you with top banking partners for the best rates.

Our Services

Loan Comparison

We analyze loan offers from various banks to help you compare interest rates, repayment terms, and eligibility criteria.

Application Assistance

Our team provides end-to-end support for your loan application, from document preparation to submission, ensuring a seamless process.

Expert Consultation

Get personalized advice from our experienced brokers who understand the UAE banking landscape and can recommend the right loan for your needs.

Banks In U.A.E

We work with a wide network of leading financial institutions in the UAE to ensure you have access to the best personal loan products available.

Emirates NBD

FAB

ADCB

Mashreq

Dubai Islamic Bank

RAKBANK

HSBC UAE

Standard Chartered

ADIB

About Quick Apply UAE

Quick Apply UAE is a leading banking brokerage firm based in Dubai, specializing in personal loan solutions. We partner with the top financial institutions in the region to provide our clients with a seamless and efficient way to secure the financing that best suits their needs.

Our mission is to simplify the complex world of personal finance by providing transparent, reliable, and personalized services. We believe that securing the right financial product should be straightforward and stress-free.

Latest Articles

How to Choose the Right Personal Loan

Confused by loan options? Our experts share essential tips to help you find the best personal loan for your financial needs.

Read More →

Key Factors Affecting Your Loan Approval

Learn about the main criteria banks use to approve personal loans and how you can prepare a strong application.

Read More →

Understanding Loan Interest Rates in the UAE

Demystify interest rates and learn how they impact your personal loan. Our guide makes it easy to understand and compare offers.

Read More →What Our Clients Say

"The team at Quick Apply UAE was incredibly helpful. They made the entire loan application process so easy and fast. I highly recommend their services!"

"I was confused about which loan to choose, but their expert advice was spot on. They found me a product with amazing benefits that I would have never found on my own."

"Professional, efficient, and friendly. Quick Apply UAE guided me every step of the way. My loan was approved in no time. Thank you!"

Ready to Apply?

Contact us today for a free consultation. Our team is ready to help you find the perfect personal loan solution.

Contact Us

Applying for a personal loan in the UAE requires specific documentation for the bank to assess your eligibility and creditworthiness. Having these documents ready is the key to a smooth and fast approval process.

Here is a comprehensive checklist of the documents required.

Standard Documents for All Applicants

These are required from everyone, regardless of employment status.

- Completed Loan Application Form:Filled out and signed.

- Passport Copy:Clear copy of the bio-data page and the page with the valid UAE residence visa.

- UAE Emirates ID:Copy of both the front and back.

Additional Documents for Salaried Employees

This applies to individuals employed by a company.

Mandatory for All Salaried Employees:

- Proof of Income:

- Last 3 Months’ Salary Slips:Official slips from your employer.

- Last 3-6 Months’ Bank Statements:Statements for the account where your salary is deposited. This is crucial for the bank to verify your salary credits and spending habits.

- Salary Certificate:A recent letter from your employer on company letterhead stating your:

- Name

- Position

- Date of joining

- Monthly gross salary (basic salary + all allowances)

Important Note for Salary Transfer Loans: If the loan requires you to transfer your salary to the lending bank, you will also need to provide a Salary Transfer Letter or complete a Salary Transfer Form provided by the bank. This form is typically signed by your employer’s HR or finance department.

Additional Documents for Self-Employed/Business Owners

Requirements are more extensive as banks need to verify the health and stability of your business.

- Company Trade License Copy:Must be current and valid.

- Company Bank Statements:Last 6 months’ statements for your business account.

- Personal Bank Statements:Last 6 months’ statements for your personal account.

- Audited Financial Statements:Company’s audited financial reports for the last 1-2 years.

Summary Table for Quick Reference

Employment Type | Required Documents |

Salaried Employees | 1. Application Form |

Self-Employed | 1. Application Form |

Crucial Tips for a Smooth Application:

- Validity:Ensure your passport, visa, and Emirates ID are valid. Expired documents will cause an immediate rejection or delay.

- Clarity:Provide clear, scanned copies of all documents. Blurry or incomplete documents will slow down the verification process.

- Accuracy:Double-check that your name, salary, and contact details are consistent across all documents and the application form.

- Debt-Burden Ratio (DBR):Remember, your total monthly debt obligations (including the new loan’s EMI) generally cannot exceed 50% of your gross monthly income. The bank will calculate this.

How to Simplify the Process:

The easiest way to manage this is to use a financial aggregator service like www.quickapplyuae.com.

- Single Upload:You can upload your documents once on their platform.

- Expert Review:Their finance experts can review your documents for completeness before submitting them to the bank, preventing avoidable delays.

- Compare Offers:They can submit your application to multiple partner banks simultaneously, helping you get the best possible interest rate and terms.

Having these documents prepared before you start your application will significantly increase your chances of a quick and successful personal loan approval.

This is a very important and specific question for the UAE banking landscape. Here’s a clear breakdown of what a Personal Salary Transfer Loan and a PDC Loan are.

Personal Salary Transfer Loan

This is the most common type of personal loan in the UAE.

What is it?

A Salary Transfer Loan is a loan where the borrower is required to transfer their monthly salary to the bank granting the loan. This is a mandatory condition for approval.

The bank sets up a Salary Transfer Mandate with your employer. This ensures your entire monthly salary is deposited directly into your account at that bank.

How it Works & Why Banks Use It:

Security for the Bank: Your salary acts as a primary form of collateral. By having your salary credited to them, the bank has first access to your income. This significantly reduces their risk, as they can automatically deduct your monthly loan installment (EMI) as soon as your salary arrives.

Lower Interest Rates: Because this method is safer for the bank, they typically offer lower interest rates on Salary Transfer Loans compared to other loan types.

Higher Approval Chance & Larger Amounts: Banks are often more willing to approve these loans and may offer a higher loan amount (a multiple of your salary) because of the reduced risk.

Key Features:

Mandatory: Requires changing your salary account to the lending bank.

Lower Rates: Generally has the most competitive interest rates in the market.

Common: Offered by almost all major UAE banks.

PDC Loan (Personal Loan with PDCs)

A PDC Loan is an alternative for individuals who do not want to transfer their salary to a new bank but still need a loan.

What is a PDC?

PDC stands for Post-Dated Cheque. It is a physical cheque written for a future date.

What is a PDC Loan?

Instead of a salary transfer, the bank secures the loan by taking a series of post-dated cheques from the borrower to cover all the future monthly installments.

For example, if you have a 36-month (3-year) loan, the bank will require 36 PDCs, each dated for the 1st of every month for the next three years.

On the date written on each cheque, the bank will deposit it to collect that month’s payment.

How it Works & Why It’s Used:

Security for the Bank: The PDCs act as a guarantee. If you fail to make a payment, the bank simply presents the cheque for that month to withdraw the funds from your account. Under UAE law, bouncing a cheque is a serious offense, which makes this a strong security for the lender.

No Salary Transfer: The main advantage for the borrower is that they do not need to change their salary account. You can keep your salary with your current bank.

Higher Interest Rates: Because this is considered a higher risk for the bank than a salary transfer (they don’t have direct control over your salary), PDC loans almost always come with a higher interest rate.

Key Features:

No Salary Transfer: You keep your salary with your existing bank.

Higher Rates: More expensive than a Salary Transfer Loan due to higher risk for the bank.

Requires Cheques: You must have a cheque book from your current bank account to provide the PDCs.

Comparison Table: Salary Transfer Loan vs. PDC Loan

Feature | Salary Transfer Loan | PDC Loan |

Salary Account | Must transfer to the lending bank. | No need to transfer; keep your existing account. |

Interest Rates | Lower (more competitive). | Higher (less competitive). |

Security for Bank | Direct access to your salary. | Post-dated cheques. |

Best For | Those willing to switch banks for a better rate. | Those who want a loan without changing their main salary account. |

Risk for Borrower | Lower financial cost. | Risk of a criminal case if a cheque bounces due to insufficient funds. |

Which One Should You Choose?

Choose a Salary Transfer Loan if your priority is to get the lowest possible interest rate and you are comfortable with moving your salary account.

Choose a PDC Loan if the convenience of keeping your existing salary account is more important to you than paying a slightly higher interest rate.

Important Note: Before providing PDCs, you must be 100% confident that your account will have sufficient funds on each cheque’s date. Bouncing a cheque in the UAE has severe legal consequences.

When comparing options on a platform like www.quickapplyuae.com, you can often see which banks offer which type of loan, allowing you to choose the product that best fits your needs.

This is a very common and important question for anyone considering a personal loan in the UAE.

It is crucial to understand that interest rates are dynamic and change frequently based on Central Bank policy, market conditions, and bank promotions. The rates mentioned here are for illustrative purposes and will likely change.

What is the Interest Rate for a Personal Loan?

In the UAE, the interest rate on a personal loan is typically presented as a fixed annual percentage rate (APR). This rate includes the interest cost plus any associated fees (like processing fees), giving you the true annual cost of the loan.

There are two main structures:

Reducing Rate: Interest is calculated on the outstanding principal balance. This is the most common and fair method.

Flat Rate: Interest is calculated on the original loan amount for the entire tenure. This is less common and makes the loan more expensive.

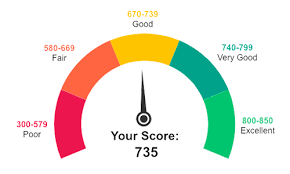

Your actual interest rate is personalized and depends on:

Your monthly salary (higher salary often gets a lower rate).

Your employer’s category (government, multinational, or private company).

Your credit score/history.

Whether you opt for a salary transfer (lower rate) or a loan without salary transfer (higher rate using PDCs).

Comparison of Interest Rates from Different Banks in the UAE

The following table provides a general comparison of the typical reducing interest rates (Annual Percentage Rate – APR) offered by major UAE banks for salary transfer loans as of late 2023/early 2024. These are illustrative and subject to change.

Bank | Starting Interest Rate (APR) * | Example EMI (for AED 100,000, 48-month tenure) | Key Feature |

Emirates NBD | From ~ 5.99% (onwards) | ~ AED 2,350 | Competitive rates for qualified customers. |

Abu Dhabi Commercial Bank (ADCB) | From ~ 5.99% (onwards) | ~ AED 2,350 | Offers loans to both salaried and self-employed. |

Mashreq Bank | From ~ 5.99% (onwards) | ~ AED 2,350 | Often has promotional offers for specific employers. |

Dubai Islamic Bank (DIB) | From ~ 6.99% (Profit Rate) | ~ AED 2,380 | Sharia-compliant financing. |

Abu Dhabi Islamic Bank (ADIB) | From ~ 6.99% (Profit Rate) | ~ AED 2,380 | Sharia-compliant financing. |

First Abu Dhabi Bank (FAB) | From ~ 6.29% (onwards) | ~ AED 2,360 | Offers a wide range of banking products. |

RAKBANK | From ~ 6.69% (onwards) | ~ AED 2,375 | Known for competitive offers. |

Commercial Bank of Dubai (CBD) | From ~ 6.49% (onwards) | ~ AED 2,370 | Good options for a wide range of customers. |

**Note: The “starting from” rate is usually reserved for high-income customers (e.g., AED 25k+/month) from prestigious companies. Most applicants will receive a rate higher than the advertised minimum.*

Loans without salary transfer (using PDCs) will generally have rates starting from ~8% – 12% APR or higher.

Which Bank Has the Lowest Interest Rate in the UAE?

As you can see from the table above, the lowest advertised interest rates often start from around 5.99% APR for a standard reducing balance loan. However, it is a very competitive market, and the title of “lowest” changes frequently between Emirates NBD, ADCB, and Mashreq Bank.

Important: The advertised “starting from” rate is a marketing tool. The rate you are personally offered could be significantly higher based on your financial profile.

How to Find the Best and Lowest Rate for YOU:

Check Aggregator Websites: The most efficient way is to use financial comparison platforms like www.quickapplyuae.com They allow you to see current offers from multiple banks in one place.

Use Bank Calculators: Every bank has a personal loan calculator on its website. Use it to get an estimated monthly payment based on your desired amount and tenure.

Contact Banks Directly: Speak to relationship managers at different banks. They can provide you with a personalized quote based on a soft credit check.

Check Your Own Bank: Often, your existing bank (where your salary is deposited) may offer you a preferential rate as you are already a customer.

Final Advice:

Never focus solely on the interest rate. Also consider:

Processing Fees: A 1-2% fee can add a significant cost to your loan.

Early Settlement Fees: Check the penalty if you want to pay off the loan early.

Your Budget: Ensure the Equated Monthly Installment (EMI) is comfortable and doesn’t exceed a reasonable percentage of your income.

Disclaimer: The interest rates provided are for general informational purposes only and are not guaranteed. They are subject to change without notice. Always get a formal quotation from the bank before making a decision.

Our Partners

QuickApplyUAE maintains strong and dynamic relationships with a comprehensive list of leading financial institutions in the UAE, including but not limited to:

Emirates NBD

First Abu Dhabi Bank (FAB)

Abu Dhabi Commercial Bank (ADCB)

Mashreq Bank

Commercial Bank of Dubai (CBD)

HSBC

Citibank

RAKBANK

Emirates Islamic Bank

Local Banks (Headquartered in the UAE)

Local Commercial Banks

These are the largest and most prominent financial institutions in the country.

Emirates NBD (Merger of Emirates Bank International and National Bank of Dubai)

First Abu Dhabi Bank (FAB) (Merger of National Bank of Abu Dhabi and First Gulf Bank)

Abu Dhabi Commercial Bank (ADCB) (Merger of ADCB and Union National Bank, and subsequent acquisition of Al Hilal Bank)

Dubai Islamic Bank (DIB) (The world’s first full-service Islamic bank)

Mashreq Bank

Commercial Bank of Dubai (CBD)

Abu Dhabi Islamic Bank (ADIB)

Emirates Islamic Bank

National Bank of Fujairah (NBF)

National Bank of Umm Al-Qaiwain (NBQ)

RAKBANK (The National Bank of Ras Al-Khaimah)

Sharjah Islamic Bank

Invest Bank

Commercial Bank International (CBI)

Local Investment Banks

Emirates Investment Bank

SHUAA Capital

Finance Companies in the UAE

Finance companies are crucial players, especially in the auto loan, personal finance, and SME lending sectors. They are often subsidiaries of major banks or independent entities.

Prominent Finance Companies include:

Abu Dhabi Finance (Specializes in mortgages)

Emirates Integrated Telecommunications Company (du) Finance (Provides payment solutions)

Finance House

Oasis Finance (Part of the Oasis Investment Company)

Amlak Finance (Specializes in real estate financing / mortgages)

Tamweel (A subsidiary of Dubai Islamic Bank, specializing in home finance)

Arab Financial Services (Provides payment solutions)

Mashreq Al Islami (The Islamic financing division of Mashreq Bank)

ETHOS (Emirates Transaction Services) (Operates UAESWITCH and provides payment infrastructure)

Personal Express Finance (PEF)

United Arab Bank – Finance Division (Offers various financing products)